Rebuilding Trust in Crypto Markets Through Privacy-First Infrastructure

Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

It is an open secret that crypto traders operating on public blockchains have to constantly face the threat of “front-running” attacks, which, in common crypto parlance occur when miners/validators/automated MEV bots spot a pending trade in the public mempool and race to insert their own orders first.

By doing so, they are able to profit off the information associated with the transaction in question before it is confirmed, something that in trad-fi arena could be likened to insider trading (the only difference being that on open blockchains it happens through code). In fact, recent Analysis has unearthed the scale of the problem, with MEV exploits draining over $700 million from Ethereum users in 2024 alone.

When traders get caught in the middle

A particularly vicious form of front-running is the “sandwich attack,” wherein a predator bot effectively encircles a large pending trade — primarily by detecting a buy order and submitting its own buy at a slightly higher price, thus pushing its overall price up.

When the original order finally executes at an inflated rate, the bot sells its tokens immediately, thereby capturing the price jump as profit. For the casual observer, all of this may sound like technical jargon but in real world terms sandwich attacks come with a real cost. For instance, earlier in March, a trader trying to swap $220,764 worth of USDC to USDT (on Uniswap V3) ended up with only $5,271 after an MEV bot intervened and netted roughly $215,500 for itself.

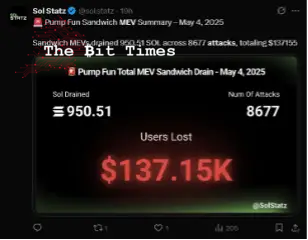

Recent stats related to MEV Sandwich drains (source: X)

Such cases, even though quite dramatic, illustrate the broader issue at hand as analysts believe that well-funded MEV bots can regularly skim profits on large trades, adding up to millions of dollars in the long run.

In this context, one promising countermeasure that individuals all over the world have begun to employ is that of fully encrypted trading. The concept is currently being championed by a platform called EnclaveX, the world’s first permissionless “fully encrypted exchange” (FEX) that aims to put professional-grade, hedge-fund-level execution power into the hands of everyday traders.

Instead of broadcasting orders on a transparent orderbook, EnclaveX sends user trades directly into secure hardware enclaves, hiding them until their final execution. According to recent reports, all of EnclaveX’s orders and transactions are obscured from third party view — within a ‘secure enclave’ — ensuring that no bots are able to jump the queue and pull off MEV and front-running attacks.

To elaborate, the technology underlying this framework borrows heavily from the concept of ‘trusted computing.’ As such, EnclaveX runs each trade inside a ‘Trusted Execution Environment’ – similar in concept to the Apple iPhone’s Secure Enclave feature – so that even network validators or node operators can’t snoop on orders.

Lastly, looking beyond the realm of encryption, EnclaveX is designed for decentralization with its core operations spread across a network of “independent attestors,” resulting in little to no trust assumptions. For the end user, this combination of end-to-end encryption and distributed attestation practically renders any type of front-running hack impossible.

What does EnclaveX offer as the first permissionless FEX?

– private orderflow

– no MEV, no sniping

– instant execution

– simple wallet or email sign up

– crosschain deposits

– no added bridge riskTrading without noise.

Be Early. pic.twitter.com/cZ37Dbl574

— Enclave Markets (@enclavemarkets) April 18, 2025

What it all means for the average user

The emergence of encrypted exchanges like EnclaveX seems to be levelling the playing field as it allows retail and other smaller-volume users to gain the same front-running immunity that institutional clients expect. If orders never appear in the public pool, there’s nothing for bots to exploit — ensuring a trader’s strategy and timing remain secret until the last moment.

Such a proposition can fundamentally alter DeFi fairness as traders no longer have to outsmart invisible bots on every large trade (making market movements flow naturally). That being said, it is also important to understand that the idea of encrypted order flows is still new and therefore needs to be approached with a certain degree of caution.

However, with the entry of projects like EnclaveX into the fray, we are effectively witnessing a live experiment actively reshaping tomorrow’s trade infrastructure. If successful, the approach can potentially witness large-scale adoption. Interesting times ahead!

Comments

Post a Comment