DeFi Today: Uniswap Dominance, DYDX Rise And DeFi TVL At 2.5 Year Lows

Another pivotal observation by IntoTheBlock revolves around the Total Value Locked (TVL) in DeFi protocols, which has recently hit a 2.5-year low. This downtrend is rooted in a series of events that led to a negative feedback loop within the ecosystem.

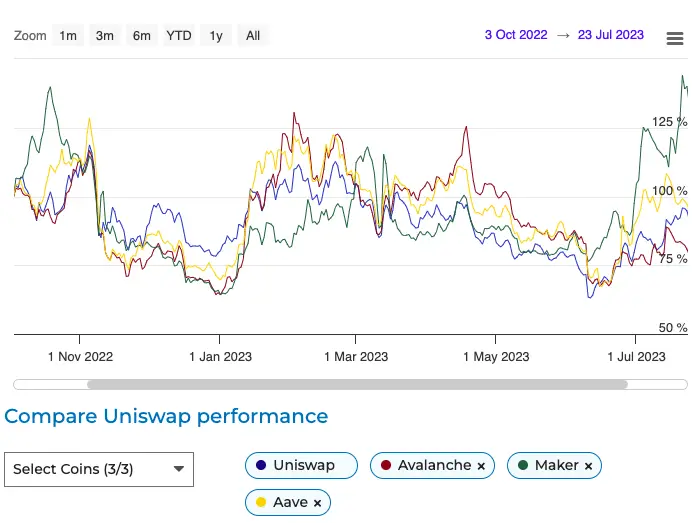

DeFi Movers: Uniswap, Maker, and Avalanche

Uniswap price a cornerstone of the DeFi space, is currently trading at at $4.57 with a 24-hour trading volume of $91 million. While it witnessed a minor 2.33% decline in the last 24 hours, its significant impact on the DeFi ecosystem remains undisputed.

Maker, a substantial player in the DeFi sector, is trading at $996.75. Despite a recent 5.93% dip in the last 24 hours, Maker’s influence in the market is undeniable. With AAVE price at $56.28, Aave has experienced a slight 0.99% decrease in the last 24 hours. Its unique approach and growing ecosystem contribute to its standing in the market.

DeFi Comeback? Fluctuating Transaction Trends and Promising Signs

With a steep 80% drop in 2022, plummeting token prices set off a chain reaction that impacted yields, eroding the perceived value of DeFi protocols. Coupled with a waning appetite for speculative investments, the current TVL slump is unsurprising, marking its lowest point since 2021.

Recommended Articles

The market Analysis unveils intriguing transaction trends, with a noticeable spike evident at the start of the current month. This surge is far from coincidental, as the data uncovers a sustained trend following a significant upswing observed in June. The robust transaction levels witnessed in this period underscore the growing adoption and resilience of certain DeFi assets.