Bitcoin Investors Await the Fed's Jackson Hole Meeting on Friday

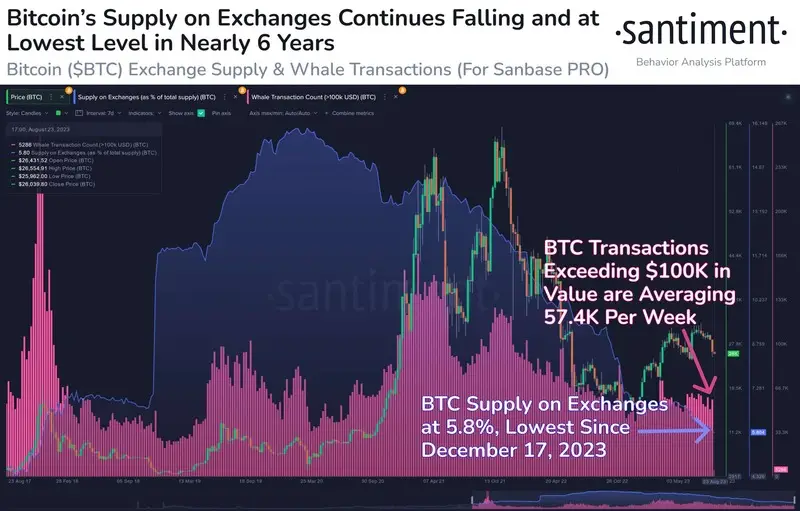

The Bitcoin supply at the exchanges has dropped to a 6-year low. Only a small portion, about 5.8%, of the total Bitcoin supply is currently held on exchanges. This marks the lowest level for the top cryptocurrency by market cap since December 17, 2017. Furthermore, there are consistent instances of significant whale transactions involving $BTC, averaging around 57.4K per week, reports Santiment.

As Exchange Reserves decrease during a market downturn, it suggests that investors are opting to hold onto their assets for potential future profits instead of selling. If this trend continues, it could lead to a substantial price increase for Bitcoin when favorable macroeconomic factors and a positive global crypto market sentiment return.

Another positive indicator is that Bitcoin whales have been accumulating recently after last week’s market crash. Since last week’s fall to $25,000, Bitcoin whales have accumulated over $300 million worth of Bitcoins so far.

#Bitcoin | Whales seem to be buying the #BTC dip. We're seeing a spike in addresses holding 1,000+ $BTC. pic.twitter.com/TXec7s8a2q

Recommended Articles

— Ali (@ali_charts) August 24, 2023

Where’s Bitcoin Moving Next? All eyes on the Fed

On the technical charts, Bitcoin continues to show weakness as it has already dropped under the 200-day moving average. For now, the immediate support zone for Bitcoin stands at $25,200-$24,800. However, breaching this could see the BTC price fall further to $20,500.

All eyes are currently on the Fed’s Jackson Hole meeting later today on Friday. U.S. Federal Reserve Chair Jerome Powell will shed light on whether or not they would be ending the interest rate hike cycle.

On the other hand, the US regulatory action on crypto firms has further dampened market sentiments. Amid the SEC action, Bitstamp decided to discontinue the Ether staking facility for US customers from next month onwards.

The cryptocurrency market might face ongoing pressure from negative sentiment in the upcoming weeks or months until there is a clear regulatory and legislative framework that governs the cryptocurrency market.